Home Office Expenses Ato 2023 . from march 2023 onwards, the ato will require each hour worked from home to be recorded. The ato also requires taxpayers using this. pcg 2023/1 provides taxpayers with a choice between the actual cost method and rfrm to calculate their. Vehicles you use for work. Be working from home to fulfil your employment duties, not just carrying out. to claim working from home expenses, you must: if you have genuinely worked from home at any time from 1 july 2022 to 30 june 2023, you may be eligible to use the ato’s. Uniforms, work clothing and tools.

from taxtank.com.au

from march 2023 onwards, the ato will require each hour worked from home to be recorded. if you have genuinely worked from home at any time from 1 july 2022 to 30 june 2023, you may be eligible to use the ato’s. Vehicles you use for work. pcg 2023/1 provides taxpayers with a choice between the actual cost method and rfrm to calculate their. The ato also requires taxpayers using this. to claim working from home expenses, you must: Be working from home to fulfil your employment duties, not just carrying out. Uniforms, work clothing and tools.

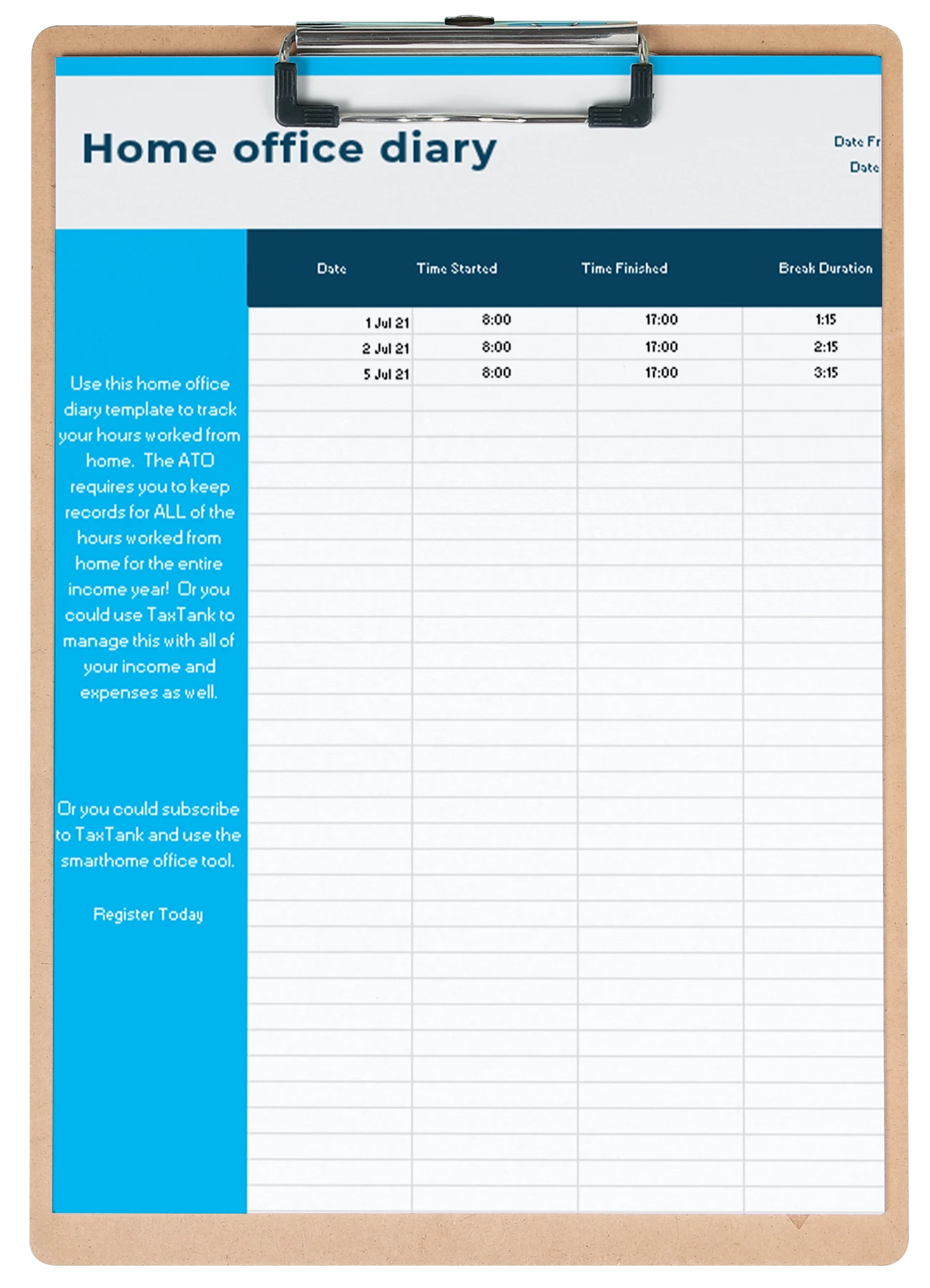

Free Home Office Expenses Diary For Better ATO Compliance

Home Office Expenses Ato 2023 if you have genuinely worked from home at any time from 1 july 2022 to 30 june 2023, you may be eligible to use the ato’s. if you have genuinely worked from home at any time from 1 july 2022 to 30 june 2023, you may be eligible to use the ato’s. from march 2023 onwards, the ato will require each hour worked from home to be recorded. Vehicles you use for work. Be working from home to fulfil your employment duties, not just carrying out. to claim working from home expenses, you must: Uniforms, work clothing and tools. The ato also requires taxpayers using this. pcg 2023/1 provides taxpayers with a choice between the actual cost method and rfrm to calculate their.

From www.bmtqs.com.au

Tax Deductions for Investment Property BMT Insider Home Office Expenses Ato 2023 pcg 2023/1 provides taxpayers with a choice between the actual cost method and rfrm to calculate their. Vehicles you use for work. Be working from home to fulfil your employment duties, not just carrying out. to claim working from home expenses, you must: The ato also requires taxpayers using this. from march 2023 onwards, the ato will. Home Office Expenses Ato 2023.

From cefzxnno.blob.core.windows.net

Home Office Expenses Ato Rate at Dennis Coulter blog Home Office Expenses Ato 2023 if you have genuinely worked from home at any time from 1 july 2022 to 30 june 2023, you may be eligible to use the ato’s. to claim working from home expenses, you must: Uniforms, work clothing and tools. Be working from home to fulfil your employment duties, not just carrying out. The ato also requires taxpayers using. Home Office Expenses Ato 2023.

From societyone.com.au

Home Office & Work From Home Expenses SocietyOne Home Office Expenses Ato 2023 to claim working from home expenses, you must: Be working from home to fulfil your employment duties, not just carrying out. pcg 2023/1 provides taxpayers with a choice between the actual cost method and rfrm to calculate their. from march 2023 onwards, the ato will require each hour worked from home to be recorded. Vehicles you use. Home Office Expenses Ato 2023.

From hrinsider.ca

Navigating The New Home Office Expense Deductions Announced By CRA HR Home Office Expenses Ato 2023 Uniforms, work clothing and tools. from march 2023 onwards, the ato will require each hour worked from home to be recorded. Be working from home to fulfil your employment duties, not just carrying out. Vehicles you use for work. pcg 2023/1 provides taxpayers with a choice between the actual cost method and rfrm to calculate their. The ato. Home Office Expenses Ato 2023.

From syccpa.com

COVID19 Home Office Expenses What You Need to Know SCARROW YURMAN & CO Home Office Expenses Ato 2023 Be working from home to fulfil your employment duties, not just carrying out. if you have genuinely worked from home at any time from 1 july 2022 to 30 june 2023, you may be eligible to use the ato’s. Vehicles you use for work. to claim working from home expenses, you must: from march 2023 onwards, the. Home Office Expenses Ato 2023.

From materialdbhutchins.z21.web.core.windows.net

Home Office Deduction Worksheet Excel Home Office Expenses Ato 2023 Vehicles you use for work. if you have genuinely worked from home at any time from 1 july 2022 to 30 june 2023, you may be eligible to use the ato’s. to claim working from home expenses, you must: pcg 2023/1 provides taxpayers with a choice between the actual cost method and rfrm to calculate their. The. Home Office Expenses Ato 2023.

From taxtank.com.au

Free Home Office Expenses Diary For Better ATO Compliance Home Office Expenses Ato 2023 from march 2023 onwards, the ato will require each hour worked from home to be recorded. to claim working from home expenses, you must: Vehicles you use for work. Uniforms, work clothing and tools. Be working from home to fulfil your employment duties, not just carrying out. pcg 2023/1 provides taxpayers with a choice between the actual. Home Office Expenses Ato 2023.

From www.corebusiness.com.au

ATO revises Working from Home expense claims for 2023 Core Business Home Office Expenses Ato 2023 from march 2023 onwards, the ato will require each hour worked from home to be recorded. pcg 2023/1 provides taxpayers with a choice between the actual cost method and rfrm to calculate their. Vehicles you use for work. if you have genuinely worked from home at any time from 1 july 2022 to 30 june 2023, you. Home Office Expenses Ato 2023.

From www.businessaccountingbasics.co.uk

Use Of Home As An Office Claiming Home Office Expenses Home Office Expenses Ato 2023 The ato also requires taxpayers using this. Be working from home to fulfil your employment duties, not just carrying out. to claim working from home expenses, you must: if you have genuinely worked from home at any time from 1 july 2022 to 30 june 2023, you may be eligible to use the ato’s. Vehicles you use for. Home Office Expenses Ato 2023.

From soundcloud.com

Stream episode January 26, 2023 Home Office Expenses by The Mad Home Office Expenses Ato 2023 to claim working from home expenses, you must: Uniforms, work clothing and tools. from march 2023 onwards, the ato will require each hour worked from home to be recorded. pcg 2023/1 provides taxpayers with a choice between the actual cost method and rfrm to calculate their. The ato also requires taxpayers using this. if you have. Home Office Expenses Ato 2023.

From www.posteezy.com

Working from Home Expenses Changes in ATO FY 2023 POSTEEZY Home Office Expenses Ato 2023 Vehicles you use for work. from march 2023 onwards, the ato will require each hour worked from home to be recorded. if you have genuinely worked from home at any time from 1 july 2022 to 30 june 2023, you may be eligible to use the ato’s. to claim working from home expenses, you must: Be working. Home Office Expenses Ato 2023.

From atotaxrates.info

Home Office Expenses Claim Rate 2024 Home Office Expenses Ato 2023 pcg 2023/1 provides taxpayers with a choice between the actual cost method and rfrm to calculate their. from march 2023 onwards, the ato will require each hour worked from home to be recorded. to claim working from home expenses, you must: if you have genuinely worked from home at any time from 1 july 2022 to. Home Office Expenses Ato 2023.

From homedesignforcovid19.blogspot.com

home office ato Home Office Expenses Ato 2023 Vehicles you use for work. The ato also requires taxpayers using this. to claim working from home expenses, you must: pcg 2023/1 provides taxpayers with a choice between the actual cost method and rfrm to calculate their. Uniforms, work clothing and tools. from march 2023 onwards, the ato will require each hour worked from home to be. Home Office Expenses Ato 2023.

From thewealthywill.wordpress.com

“Cutting Costs Tips for Managing Home Office Expenses During the Home Office Expenses Ato 2023 The ato also requires taxpayers using this. if you have genuinely worked from home at any time from 1 july 2022 to 30 june 2023, you may be eligible to use the ato’s. to claim working from home expenses, you must: Be working from home to fulfil your employment duties, not just carrying out. Vehicles you use for. Home Office Expenses Ato 2023.

From excelguider.com

Home Office Expense Spreadsheet — Home Office Expenses Ato 2023 Uniforms, work clothing and tools. The ato also requires taxpayers using this. Vehicles you use for work. if you have genuinely worked from home at any time from 1 july 2022 to 30 june 2023, you may be eligible to use the ato’s. Be working from home to fulfil your employment duties, not just carrying out. to claim. Home Office Expenses Ato 2023.

From www.youtube.com

2023 Budget With Me Expenses + Savings Simple And Realistic Excel Home Office Expenses Ato 2023 from march 2023 onwards, the ato will require each hour worked from home to be recorded. if you have genuinely worked from home at any time from 1 july 2022 to 30 june 2023, you may be eligible to use the ato’s. Be working from home to fulfil your employment duties, not just carrying out. The ato also. Home Office Expenses Ato 2023.

From karolywalysa.pages.dev

Ato Home Office Expenses 2024 magda ursulina Home Office Expenses Ato 2023 Be working from home to fulfil your employment duties, not just carrying out. pcg 2023/1 provides taxpayers with a choice between the actual cost method and rfrm to calculate their. from march 2023 onwards, the ato will require each hour worked from home to be recorded. to claim working from home expenses, you must: Vehicles you use. Home Office Expenses Ato 2023.

From soundcloud.com

Listen to playlists featuring February 2, 2023 Employee Home Office Home Office Expenses Ato 2023 to claim working from home expenses, you must: The ato also requires taxpayers using this. Be working from home to fulfil your employment duties, not just carrying out. if you have genuinely worked from home at any time from 1 july 2022 to 30 june 2023, you may be eligible to use the ato’s. Uniforms, work clothing and. Home Office Expenses Ato 2023.